We’re all creatures of habit, whether that means getting up early to run or stumbling to our coffee cup, reading the classics or binge watching Netflix, saving our pennies or spending them. These habits, the little things we do on a daily, weekly or monthly basis, have an enormous impact on our health and wellness – physically and emotionally, yes, but also financially.

Everyone knows by now the popular concept of self-care is all about reducing stress and making life a little bit better. Building healthy financial behaviors is an important part of self-care. Although financial behaviors often seem entrenched, they are really no different than other types of behavior, which means that with some thought and effort, they can be changed if they’re not cutting it or enhanced if they’re on the right track.

Money worries are stressing us out

Finances remain a huge source of stress for most people, often worse than family or work. A March 2024 Bankrate survey found that personal finances were the leading cause of anxiety among Americans, with 47 percent saying money has a negative effect on their mental health, higher than worries about their own health (39 percent) or relationships with family and friends (30 percent), among other things. The generations most likely to say money was their greatest source of stress were Gen Z and Millennials.

The respondents to the survey were worried about everything from paying for everyday expenses to rising interest rates, but among the most pressing concerns were inflation (65 percent mentioned this), not having emergency savings (56 percent) and being in debt (47 percent).

Worrying about money in turn can affect a person’s mental health and make problems such as depression worsen and last longer. Financial stress also can cause physical symptoms like fatigue and insomnia and even lead to chronic health conditions like diabetes and heart disease.

A report by global professional services firm EY found that financial stress experienced by employees can lead to higher absenteeism, compromised work quality, lower productivity, higher healthcare costs, more accidents on the job, increased turnover, and, ultimately, lower profits for the company.

The report concluded that “employers can benefit from implementing an employee wellbeing program that includes financial health as a key component.”

Groove

Groove is a new personal finance platform that tackles the problem of money anxiety with a unique approach, taking into account emotions and personality and focusing on habit building. Developed by the Singleton Foundation for Financial Literacy and Entrepreneurship, Groove uses behavioral science to help users build good financial habits, providing positive reinforcement and encouraging them to set and meet goals. Users can track their progress on important financial steps like paying down debt, building a savings account, starting to invest or simply being more confident about managing their money.

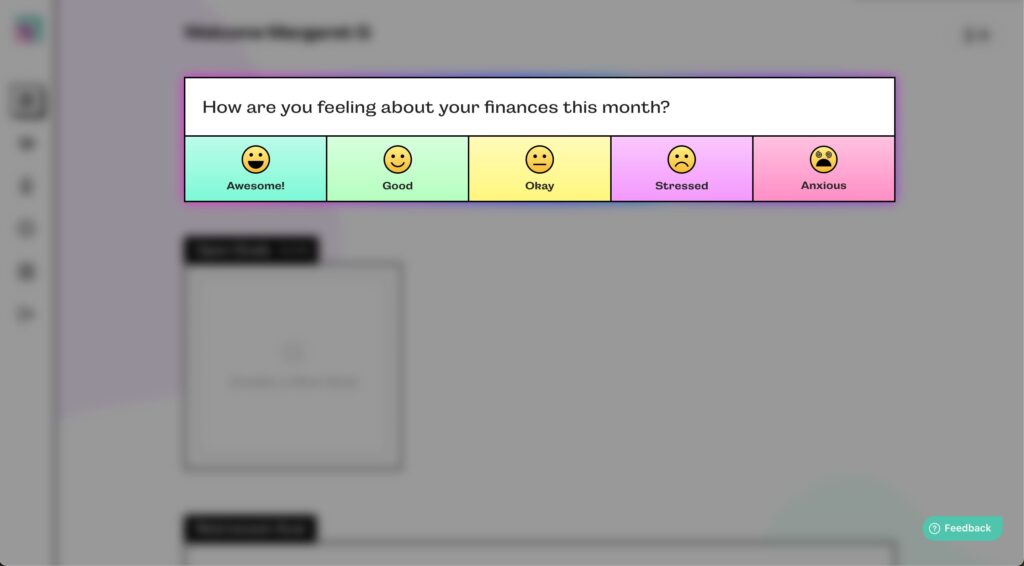

The first thing that happens when you log in to Groove is that you’re asked about your emotions, about how you’re feeling today – feeling good, feeling anxious, or something in between. If you’re feeling stressed, Groove suggests some breathing exercises to help calm you. Groove even has a money personality assessment and a quiz asking about your purpose in life, with the aim of helping you figure out how money fits into all that.

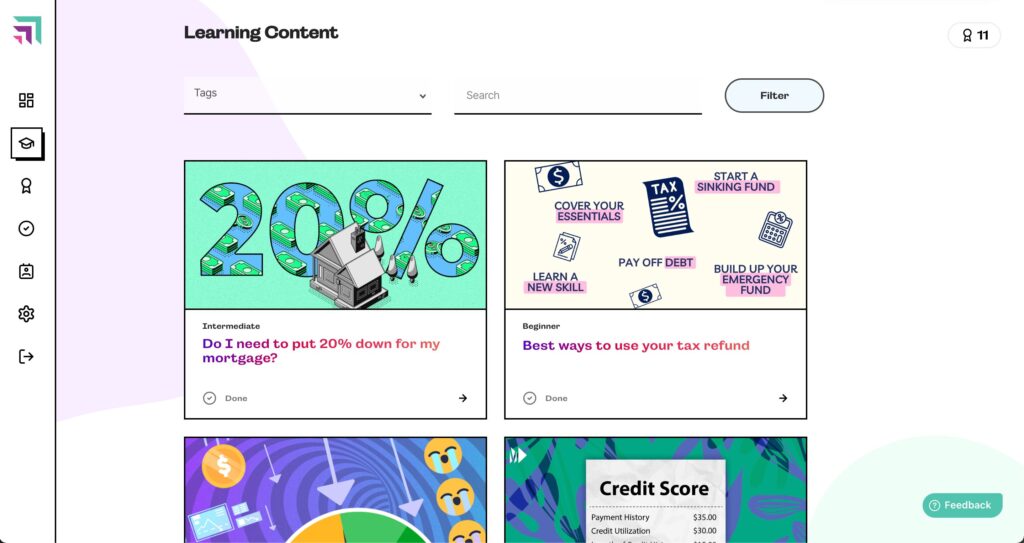

Educational personal finance content on the platform – articles, videos, infographics, short articles and games – is presented in an easy-on-the eyes format and covers topics from investing to student loans to retirement. Users are encouraged to keep track of how many topics they’ve covered as a way of promoting their financial literacy.

In a recent University of Oregon case study, almost 90 percent of students using Groove said it was effective or very effective at helping them improve their financial literacy.

“There were so many things on the Groove platform that I would’ve never even thought about or thought to research on my own time,” one student said.

Nearly three-quarters of the students in the case study said Groove was effective or very effective at helping them develop healthy money habits.

“The Groove money cash flow chart helped me calculate how much money I was making and where it was going on a monthly schedule. … Setting my savings goal in the Groove money platform helped me break some of the spending habits I had noticed in myself,” another student said.

Indeed, that’s the idea.

Leave a Reply