Written By: Andi Wrenn, MA, AFC®

Last year at the AFCPE® Symposium I presented on the topic of using genograms with clients. I very much enjoy working with clients to set and reach goals that work for them based on their values and beliefs. Working mostly with couples, I have found that using genograms has been beneficial. A genogram, sometimes called a family map, is a tool that can be used to give clients insight into their family history. Often 4-5 generations will be included on the genogram. There are specific symbols and notations used so that clients and the professionals that work with them can see at a glance the family dynamics. I was first introduced to genograms during my family system theory course while obtaining my masters in counseling. When working with clients in the counseling field using a genogram, I was intrigued that current financial behaviors could be linked to the generations in their family tree.

For most people their financial decisions are related to values and biases that they have come about due to their upbringing. Grandparents, parents, other family members, and close friends can have a huge influence on their financial decisions. A parent can be a model of what to do, or what not to do with their finances. This financial history is how a genogram can come to be helpful when working with clients in the financial arena. There are a couple ways financial counselors can use genograms when working with clients.

As a professional using this tool to better understand client relationships, you can complete the genogram as clients let you know about their family and close friends. It can be used during your time with your client, or afterwards. Having the beginning diagram on your clipboard, you can begin filling it out as the client talks about their life. Filling in the general information, and information that you feel is most important to the reason for which they are there to see you. The map could also be completed after they leave. You can use the genogram to review prior to your next session with the client. The genogram made for your personal use can be used in future sessions as more information is shared that would be helpful to understanding complicated relationships related to their financial influences & goals.

The option I use most is to have the client create and fill out the genogram. I typically use it during the second session, after I have the initial information gathering session. During the second session I explain that it would be helpful to learn about their family and how any presenting financial issues relate to their relationships. I have found that my clients often really enjoy doing this. I give each person in the couple a piece of paper, give them a sheet with symbols, and get out my colored pencils. Clients seem to be relaxed as they work on the genogram, often they talk about the people they are putting in their map as they complete it. A genogram is a point in time tool, showing where the key person is at the point in time that they are completing the diagram. The genogram can be completed when a client begins with you, and then later to see how things have changed.

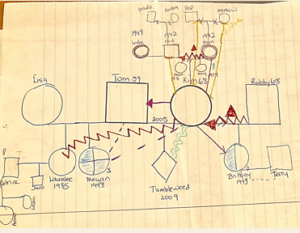

The diagram starts with circles (women) and squares (men) as you have seen in family trees depicting the make-up of their immediate family. Clients begin filling in information for their immediate family, then extended family on the genogram, and can add in any close friends that are highly influence them. Next we begin talking about relationships. They will add the type of connections they have with their family members; close, strained, hostile, fused, etc. Addiction, and mental or physical illnesses can be added, all of which have specific ways to show this visually. I have them draw direct lines to the people who influenced them the most in their financial beliefs and values. I use a green line for those who were positive financial connections, and a red line for those who negatively influenced their financial beliefs. Some of the financial themes that can be traced through patterns in the family map are: bankruptcy, divorce, spending habits, money for college, weddings, home ownership, inheritance, drug use and abuse, health issues, etc. Clients can be asked if there are any financial stressors that they see in previous generations or with their children and grandchildren.

Here is an example of one spouse’s genogram from the sample couple used in the class. Using the links at the end of the article you can see the symbols and learn more about using genograms.

In working with clients it has been most successful for them to see where they have gotten their beliefs and biases through using the genogram. I work to help them to set up goals that will work within their values, and to help them set up future generations for success as well. It is great to see them come together. Often times a couple comes from very different backgrounds in many ways including financial history. By going through this exercise, it helps them come together and understand things that don’t normally get communicated. Seeing the financial impact of previous generations, and talking about what they want future generations to learn from them is a huge part of the success I have using this tool. I hope that you find this tool useful in your work whether you are working with clients via one session, or multiple sessions. I would like to see a study to see the true impact a genogram could have on clients.

Resources related to Genograms can be found below:

- Book: Genograms: Assessment and Intervention 3rd Edition, by Monica McGoldrick, Randy Gerson, Sueli Petry

- Book: The Genogram Casebook A Clinical Companion to Genograms: Assessment and Intervention, by Monica McGoldrick

- Website: https://multiculturalfamily.org/

- Website: https://www.genopro.com/genogram/

- Website: https://www.smartdraw.com/

- Website: http://www.genogram.org/

- Ipad app: http://www.ilogotec.com/igenogram-1-8/