Written By: Shari Evans, AFC®, MQFP®

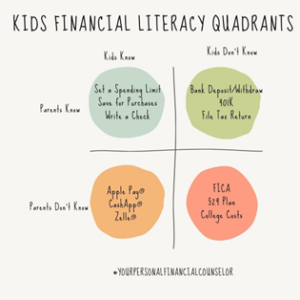

In this article of the AFCPE Kids Corner, I invite you to use the Financial Literacy Quadrants (a term I created based on the Johari Window Model® by Luft and Ingham) as a guide to help focus your financial literacy efforts for adolescents.

READY

Parental Guardians introduce financial literacy to children in early childhood. This introduction begins with the language we use as part of everyday living. Language such as “how much does it cost, we’ll save for that, will you be paying with cash or credit”, etc. As children’s vocabulary and understanding of the world around them expands, they begin to develop their financial literacy norms. These norms are often shaped by their environment and interpretation of experiences with financial transactions. As a parent of two fast-growing children, I look for opportunities to uncover the financial literacy norms and blind spots of my kiddos. Once I identify their norms and blind spots, I target my financial literacy efforts towards those areas.

SET

Why should we uncover financial literacy blind spots?

In our current era, technology has vastly changed how currency is exchanged. Although the current generation of minors is heavily exposed to digital currency exchanges (Apple Pay®, CashApp®, etc.), there is still value in ensuring our adolescents are skilled in the fundamentals of personal finance. These fundamentals are things like creating and maintaining a budget, setting a spending limit, saving for purchases, writing a check, maintaining a checkbook register, and going into a bank for in person deposits or withdrawals.

In the “Financial Literacy Quadrants”, I provide some financial literacy topics that you can use to gauge where your children or minor clients are in their financial literacy journey. In our example, we are going to use the kid (minor/child) as the “self” and the parent/guardian as the “known to others” (a parallel to the Johari Window Model® by Luft and Ingham).

GO

Here are some suggestions. Ask the minor/child about their understanding of these topics and then place the topic in one of the quadrants. The topics that end up in the “not known to kids” quadrant are the areas you can target in your child/minor financial literacy efforts.

Personal Financial Literacy Topics for the Kids Financial Literacy Quadrants:

- How to write a check

- How to use a check register to balance a check book

- How to open a bank account

- How to use a budget to manage their money

- Understanding of Compounding interest

- What is a High Yield Savings Account

- What is a credit score

- How to make a cash deposit or withdrawal inside of a bank with a bank teller

- How to use Apple Pay for teenagers with smart phones

- How to safely use digital pay like Venmo®, Zelle®, CashApp® etc

- What is a 529 Plan

- What is FICA

- What are Federal Taxes

- What is a tax return and when do you have to file one

- What is a 401k or an IRA

- What does it cost to go to the colleges they are interested in

- How to pay for college debt free with scholarships etcetc.

- How to save up to buy a car with cash

- How to earn cash in an age-appropriate manner with their skills

- What is credit card interest

- What are payday lenders

- What does it really cost to buy a car on a 60-month or 72-month loan verses cash

- How much do their weekly convenience store snacks cost over a month/year

- How much money will they spend for Homecoming/Prom and how to save for it

- How to make a weekly meal plan and shop for groceries with a preset budget

- How to budget their allowance for the month

- How to budget for recurring celebrations like birthdays and holidays

My hope is that this Financial Literacy Quadrant inspires you to have meaningful financial literacy interactions with the minor/children in your life. I also use a modified version of this model when I meet with new clients. It’s a non-threatening reference that gets financial literacy conversations started and it’s really a fun tool for couples.